Interact Analysis 更新工業機器人預測:機器人類型、地區和行業差異較大

http://www.sharifulalam.com 2024-12-20 16:47 來源:

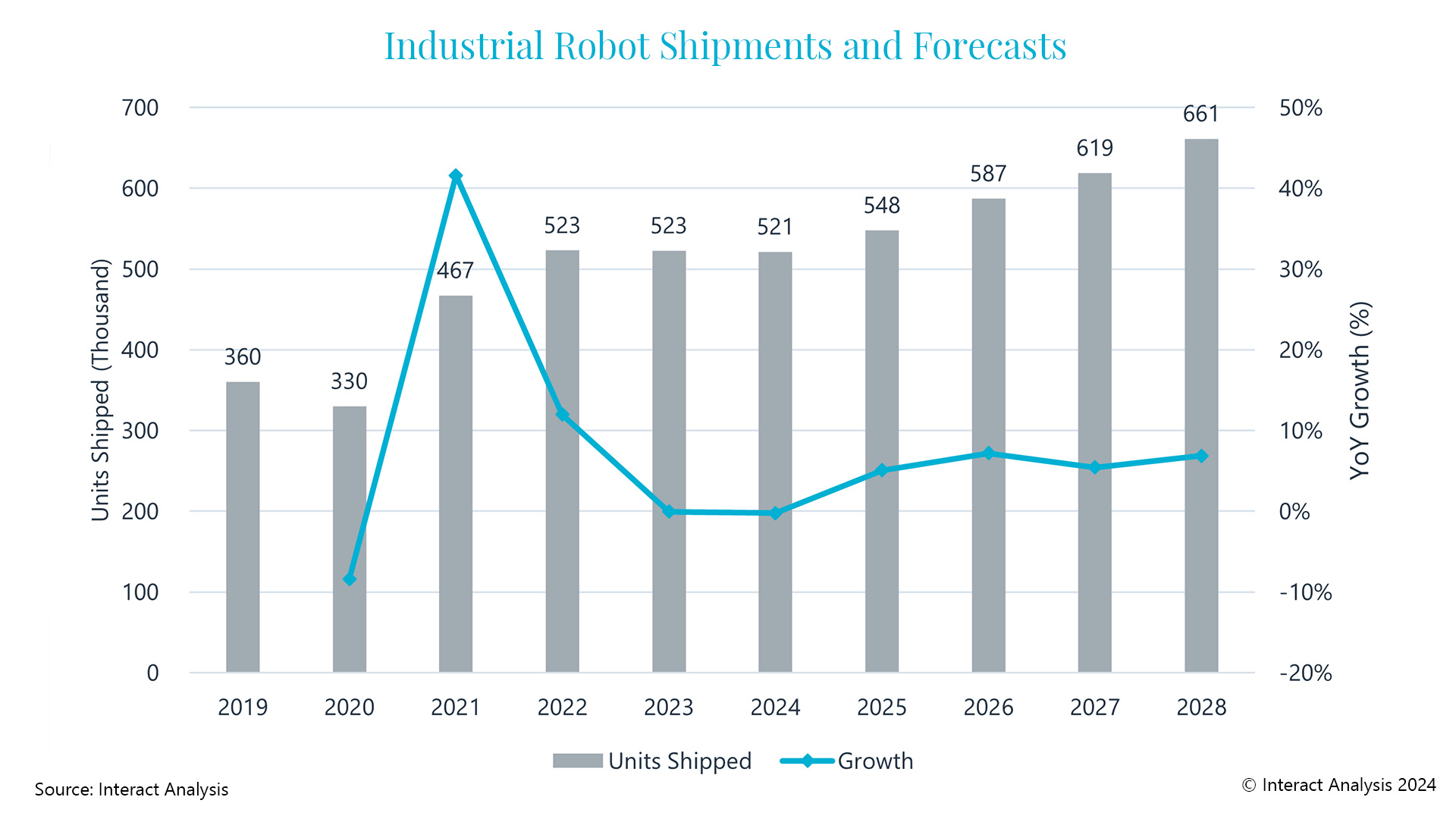

The industrial robot market is facing a mixed picture over the coming years, with 2024 set to end on a challenging note. Global robot shipments are projected to decline by 0.2%, following a flat performance in 2023. Compared with our May 2024 forecast, we have revised our 2024 projections for overall shipments downward by 5.8%; from over 553,000 units to 521,328 units. Additionally, the expected growth for 2025 has been reduced by 0.7 percentage points. These revisions reflect weaker-than-anticipated sales to the automotive industry in the second half of 2024 within the US and Europe, along with continued sluggish demand in China.

未來幾年,工業機器人市場將面臨喜憂參半的局面,2024 年將以充滿挑戰的方式結束。繼 2023 年表現平平之后,全球機器人出貨量預計將下降 0.2%。與 2024 年 5 月的預測相比,我們已將 2024 年的整體出貨量預測下調了 5.8%;從超過 553,000 輛增加到 521,328 輛。此外,2025 年的預期增長率已下調 0.7 個百分點。這些修正反映了 2024 年下半年美國和歐洲汽車行業的銷售額弱于預期,以及中國需求持續低迷。

Despite these challenges, we expect a gradual recovery in 2025. This is driven by anticipated increases in machinery investments – as key economies lower interest rates – alongside a broader recovery in the global manufacturing sector. However, factors such as high inventory levels and weak order intake are likely to persist in many industry sectors. This could potentially dampen robot demand during the first half of 2025. We forecast that industrial robot shipments will return to growth rates of over 7% by 2026.

盡管存在這些挑戰,我們預計 2025 年將逐步復蘇。這是由于主要經濟體降低利率,預期機械投資將增加,同時全球制造業將全面復蘇。然而,高庫存水平和疲軟的訂單量等因素可能會在許多行業領域持續存在。這可能會抑制 2025 年上半年的機器人需求。我們預測,到 2026 年,工業機器人出貨量將恢復到 7% 以上的增長率。

預計到2025年,全球機器人出貨量將達到548,000臺

Market by Robot Type:

按機器人分類市場:

Collaborative robots (cobots) stand out as a key growth area. We expect to see a 15.9% increase in shipments in 2024, despite the global economic slowdown. However, as competition increases, the price decline for cobots has been the most pronounced, resulting in a slower projected revenue growth rate of 11% during 2024.

協作機器人 (cobots) 是一個關鍵的增長領域。盡管全球經濟放緩,我們預計 2024 年的出貨量將增長 15.9%。然而,隨著競爭的加劇,協作機器人的價格下降最為明顯,導致 2024 年預計收入增長率將放緩至 11%。

SCARA robots are expected to see modest growth of 1.8% in 2024, fuelled by demand recovering in Asia’s semiconductor and electronics sectors. In contrast, other robot types will experience declines in shipments of 1-3% over the year, primarily due to challenges within the automotive and broader industrial sectors.

在亞洲半導體和電子行業需求復蘇的推動下,預計 SCARA 機器人將在 2024 年實現 1.8% 的溫和增長。相比之下,其他機器人類型的出貨量將在一年內下降 1-3%,這主要是由于汽車和更廣泛的工業部門面臨的挑戰。

Regional Market Dynamics:

區域市場動態:

Americas:

美洲

Robot shipments in the Americas are projected to contract by 6.6% in 2024, primarily due to sluggish demand from the automotive industry. Shipments in the electronics and metal sectors are also experiencing declines. While demand for robots in consumer-related sectors is growing, it is not enough to offset the downturn in other industries. However, the life sciences sector has been a bright spot, with strong growth in demand for robots used in pharmaceutical production and medical device assembly in the US.

預計到 2024 年,美洲的機器人出貨量將收縮 6.6%,主要是由于汽車行業的需求低迷。電子和金屬行業的出貨量也在下降。雖然消費相關行業對機器人的需求不斷增長,但這不足以抵消其他行業的低迷。然而,生命科學領域一直是一個亮點,美國對用于制藥和醫療設備組裝的機器人的需求強勁增長。

From 2024 to 2028, industrial robot shipments in the Americas are expected to grow at a CAGR of 6.1%. After the double-digit growth seen in 2021 and 2022, it is expected that the market will stabilize and expand at a more moderate pace in the coming years. We anticipate the continued trend towards greater automation and US reshoring initiatives will support the growth of manufacturing and demand for robots in the region.

從 2024 年到 2028 年,美洲的工業機器人出貨量預計將以 6.1% 的復合年增長率增長。在 2021 年和 2022 年實現兩位數增長之后,預計未來幾年市場將穩定下來并以更溫和的速度擴張。我們預計,自動化程度的持續趨勢和美國的回流計劃將支持該地區制造業的增長和對機器人的需求。

Asia Pacific:

亞太

In 2024, robot shipments in Asia Pacific are expected to increase by 2.3%, driven by a 3.3% increase in China and a 4.9% rise in the rest of APAC (excluding Japan and South Korea).

到 2024 年,亞太地區的機器人出貨量預計將增長 2.3%,其中中國增長 3.3%,亞太地區其他地區(不包括日本和韓國)增長 4.9%。

- The Indian manufacturing industry continues to experience strong growth in 2024, spurred on by government investments in infrastructure. Industrial robots are rapidly gaining traction in India.

- The robot market in Taiwan and Southeast Asia is also seeing steady growth, fuelled by recovery of the semiconductor industry.

- China’s manufacturing sector is facing another challenging year in 2024. Due to overcapacity in the EV battery and solar panel industries, robot shipments in these sectors are expected to decrease by nearly 10%. Additionally, robot demand in the automotive and electronics sectors is expected to show only modest growth.

- 在政府對基礎設施投資的刺激下,印度制造業在 2024 年將繼續強勁增長。工業機器人在印度迅速受到關注。

- 在半導體行業復蘇的推動下,臺灣和東南亞的機器人市場也正在穩步增長。

- 2024 年,中國制造業將面臨又一個充滿挑戰的一年。由于電動汽車電池和太陽能電池板行業的產能過剩,預計這些行業的機器人出貨量將下降近 10%。此外,預計汽車和電子行業的機器人需求將僅出現適度增長。

From 2024 to 2028, robot shipments in Asia Pacific are projected to grow at a compound annual growth rate (CAGR) of 6.2%. Excluding China, South Korea and Japan, the region is expected to record a CAGR of 7.4%. Southeast Asian countries are emerging as key hubs for the electronics, semiconductor, and automotive industries, with international companies increasingly establishing factories there. This is expected to help drive robot demand.

從 2024 年到 2028 年,亞太地區的機器人出貨量預計將以 6.2% 的復合年增長率 (CAGR) 增長。除中國、韓國和日本外,該地區的復合年增長率預計將達到 7.4%。東南亞國家正在成為電子、半導體和汽車行業的主要中心,越來越多的國際公司在那里建廠。預計這將有助于推動機器人需求。

Europe, Middle East and Africa (EMEA):

歐洲、中東和非洲

In 2024, robot shipments in EMEA are expected to decline by 9.2%. In Europe, orders sharply deteriorated in the second quarter, particularly in the automotive sector. Like North America, robot shipments in the European life sciences and food & beverage industries are expected to see smaller declines (2-3%), in contrast to the larger contractions anticipated in industries such as automotive, metal, and rubber & plastics. Although the new energy segment in Europe is comparatively small, it is also expected to experience a significant drop in robot shipments.

到 2024 年,歐洲、中東和非洲地區的機器人出貨量預計將下降 9.2%。在歐洲,第二季度訂單急劇惡化,尤其是汽車行業。像北美一樣,歐洲生命科學和食品飲料行業的機器人出貨量預計將出現較小的下降(2-3%),相比之下,汽車、金屬、橡膠和塑料等行業預計會出現較大的收縮。盡管歐洲的新能源細分市場相對較小,但預計機器人出貨量也將大幅下降。

From 2024 to 2028, we expect robot shipments in the EMEA region to grow at a CAGR of 5.6%. Demand growth in Eastern Europe is expected to accelerate with the expansion of the automotive supply chain in the region. Specialist countries in the life sciences sector, such as Denmark and Switzerland, are also expected to see above-average growth. However, larger manufacturing hubs, like Germany, are anticipated to experience slower growth, due to the ongoing recession in the manufacturing sector and structural challenges that could hinder economic recovery.

從 2024 年到 2028 年,我們預計歐洲、中東和非洲地區的機器人出貨量將以 5.6% 的復合年增長率增長。隨著該地區汽車供應鏈的擴張,預計東歐的需求增長將加速。預計丹麥和瑞士等生命科學領域的專業國家也將出現高于平均水平的增長。然而,由于制造業的持續衰退和可能阻礙經濟復蘇的結構性挑戰,預計德國等較大的制造業中心將出現增長放緩。

In conclusion, the industrial robot market is navigating through a period of instability, with regional and sector-specific challenges influencing overall growth. While 2024 is a year of contraction, the medium-term outlook is more positive, especially as economic recovery gains momentum and new opportunities arise for automation.

總之,工業機器人市場正在經歷一段不穩定時期,區域和特定行業的挑戰影響了整體增長。雖然 2024 年是收縮之年,但中期前景更加樂觀,尤其是在經濟復蘇勢頭增強和自動化新機遇出現的情況下。

相關新聞

- ? 翼菲智能沖刺港交所 為國內領先的綜合性工業機器人企業

- ? 2025RoBoLeague機器人足球聯賽總決賽在北京亦莊開賽

- ? 越疆CR 30H新品發布,行業最快30kg大負載協作機器人,來了!

- ? 雙展聯動,智啟未來:慕尼黑國際光博會與慕尼黑國際機器人及自動化技術博覽會開啟行業新篇章!

- ? 華龍訊達發布“龍芯+鴻蒙”工業機器人專用控制器

- ? 工業級機器人進入量產前夜,大摩預計2028中國機器人市場規模超千億美元

- ? 海康機器人第三代工業相機CT系列震撼發布!

- ? 智元主辦的全球具身智能挑戰賽正式開啟!

- ? 即將實施!節卡機器人主導制定《機器人智能化視覺評價方法及等級劃分》國家標準

- ? 第二十四屆全國大學生機器人大賽ROBOTAC在煙臺開幕