運動控制市場預計到2026年將實現5.5%年均增長

http://www.sharifulalam.com 2022-09-23 14:51 《中華工控網》翻譯

Motion Control Market Predicted For 5.5% CAGR Out To 2026

運動控制市場預計到2026年將實現5.5%年均增長

Motion control products are used in all industries, wherever precise, controlled movements are required. This diversity means that, while many industry sectors currently face an uncertain future, our predictions for the motion control market remain relatively positive for the mid-to long-term, with $19bn of sales predicted for 2026, up from $14.5bn in 2021.

運動控制產品用于所有需要精確、受控運動行業。這種多樣性意味著,盡管許多行業目前面臨不確定的未來,但我們對運動控制市場的中長期預測仍然相對樂觀,預計2026年的銷售額為190億美元,高于2021年的145億美元。

Major factors impacting growth

影響增長的主要因素

The COVID-19 pandemic has had both a positive and a negative effect on the motion control market. On the positive side, there was an immediate boost in APAC, as many vendors in that region saw a significant expansion of markets as demand surged for the manufacture of pandemic products such as PPE and ventilators. A longer-term positive is the enhanced awareness of the need for more automation in factories and warehouses to future-proof production against further pandemics and solve the problem of labor shortages.

新冠大流行對運動控制市場同時產生了積極和消極的影響。從積極方面來看,亞太地區即時出現增長,因為該地區的許多供應商都看到了市場的顯著擴張,對生產個人防護設備和呼吸機等流行病產品的需求激增。長期積極的一面是人們對工廠和倉庫需要更多自動化的意識增強,以應對未來的大流行病并解決勞動力短缺問題。

On the negative side, at the height of the pandemic, short-term growth was stifled by factory closures and social-distancing measures. Also, suppliers found themselves focusing their efforts on production rather than research and development, potentially hindering future growth. Digitalization – the drive to Industry 4.0 and the Internet of Things will continue to drive motion control sales, as will the sustainability agenda, which will likely open up new markets for motion control products in new energy industries such as the wind turbine and li-ion battery sectors.

不利的一面是,在大流行最嚴重的時候,短期增長被工廠關閉和社會隔離措施所扼殺。此外,供應商發現自己將精力集中在生產而不是研發上,這可能會阻礙未來的增長。數字化——工業4.0和物聯網的驅動力將繼續推動運動控制的銷售,可持續發展議程也將推動風力渦輪機和鋰離子電池等新能源行業成為運動控制產品的新市場。

So there is plenty to feel positive about, but let’s not forget the two big problems many industries are currently struggling with – supply issues and inflation. Semiconductor shortages have slowed down the production of drives, and shortages of rare earth metals and raw materials have affected motor production. Meanwhile, shipping costs have spiralled, and strong inflation will almost certainly cause people to think carefully about investment in automation products.

因此,有很多值得樂觀的地方,但我們不要忘記許多行業目前正在努力解決的兩大問題——供應問題和通貨膨脹。半導體短缺導致驅動器生產放緩,稀土和原材料短缺影響電機生產。與此同時,運輸成本呈螺旋式上升,強勁的通貨膨脹幾乎肯定會導致人們認真考慮對自動化產品的投資。

APAC leads the way

亞太地區引領潮流

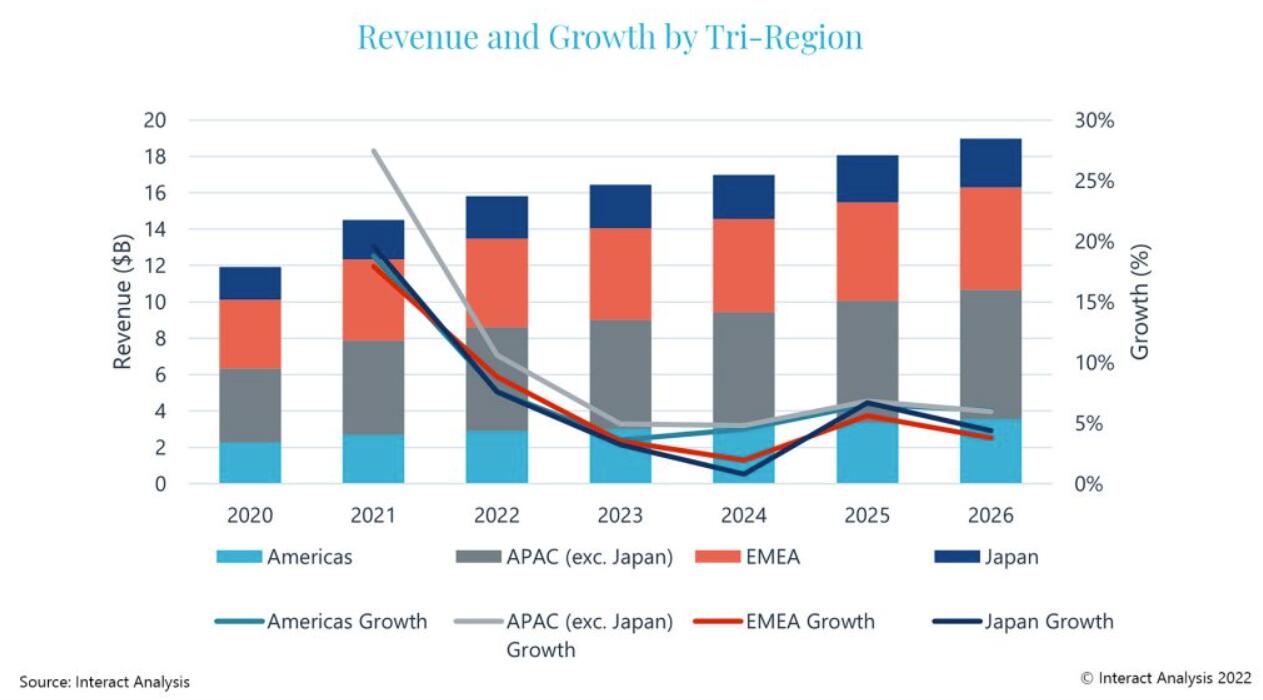

The relatively poor performance of the motion control market in 2020 led to reciprocal pressure in 2021 which inflated growth figures for that year. The post-covid rebound meant that total revenues grew from $11.9bn in 2020 to $14.5bn in 2021, representing a year-on-year market growth of 21.6%. APAC, notably China with its huge manufacturing and machinery production sectors, was the main driver behind this growth, accounting for 36% of global revenues ($5.17bn) and, not surprisingly, the region saw the highest growth – 27.4%.

2020年運動控制市場相對較差的表現導致2021年的相互壓力,從而夸大了當年的增長數據。疫情后的反彈意味著總收入從2020年的119億美元增長到2021年的145億美元,市場同比增長21.6%。亞太地區,尤其是擁有龐大制造業和機械生產部門的中國,是這一增長的主要驅動力,占全球收入的36%(51.7億美元),毫不奇怪,該地區的增長率最高,達27.4%。

Companies in the APAC region seemed better able to handle supply chain issues than their counterparts in other regions. But EMEA wasn’t far behind, generating motion control revenues of $4.47bn, making up 31% of the global market. The smallest region was Japan, with sales worth $2.16bn, accounting for a still not insignificant 15% of the global market. In terms of product type, servo motors led in 2021, with revenues of $6.51bn. Servo drives occupied the next largest market segment, generating revenues of $5.53bn.

亞太地區的公司似乎比其他地區的同行更能處理供應鏈問題。但歐洲、中東和非洲也不甘落后,產生了44.7億美元的運動控制收入,占全球市場的31%。最小的地區是日本,銷售額為 21.6億美元,占全球市場的15%。在產品類型方面,伺服電機在2021年處于領先地位,收入為65.1億美元。伺服驅動器占據第二大細分市場,創造了55.3 億美元的收入。

$19bn sales predicted for 2026; up from $14.5bn in 2021

預計2026年銷售額將達到190億美元;高于2021年的145億美元

So where is the motion control market going from here? Clearly, we cannot expect the high growth seen in 2021 to be sustained, but concerns about over-ordering in 2021 leading to cancellations in 2022 have not materialised so far and respectable growth 0f 8-11% is predicted for 2022. There will be a slowdown from 2023 onwards, though, as the general outlook for manufacturing and machinery production declines. However, the longer-run picture between 2021 and 2026 will still see the total global market increase from $14.5bn to $19bn, equating to a global CAGR of 5.5%.

那么運動控制市場將何去何從?顯然,我們不能指望2021年的高增長會持續下去,但對 2021年過度訂購導致2022年取消的擔憂迄今尚未成為現實,預計2022年將實現8-11% 的可觀增長。不過,隨著制造業和機械生產的總體前景下降,從2023年開始放緩。然而,從 2021年到2026年的長期情況,全球市場總額仍將從145億美元增加到190億美元,相當于全球復合年增長率為5.5%。

APAC, where the motion control market will see a CAGR of 6.6% over the forecast period, will continue to be the dominant driver. China is predicted to see its market size grow from $3.88bn in 2021 to $5.33bn in 2026, an increase of 37%. Recent events have caused some uncertainty in China though. China fared well in the early onset of the pandemic, and exports of motion control products grew owing to increased demand from countries where production was disrupted by the virus. But the region’s current zero-tolerance battle with the virus means lockdowns in major port cities such as Shanghai could still hold back the local and global motion control market. The possibility of further lockdowns in China in the near future is probably the single biggest uncertainty that the motion control market currently faces.

亞太地區的運動控制市場在預測期內的復合年增長率將達到6.6%,繼續成為主要驅動力。預計中國的市場規模將從2021年的38.8億美元增長到2026年的53.3億美元,增長37%。不過,最近的事件在中國造成了一些不確定性。中國在大流行初期表現良好,由于生產受到病毒干擾的國家的需求增加,運動控制產品的出口增長。但該地區目前對病毒的零容忍政策意味著上海等主要港口城市的封鎖仍可能阻礙本地和全球運動控制市場。在不久的將來,中國進一步封鎖的可能性可能是運動控制市場目前面臨的最大不確定性。

相關新聞

- ? 西門子運動控制業務研發創新中心正式投入運營

- ? 施耐德電氣 Modicon M310 新品發布,總線型運動控制的絕佳伙伴!

- ? 派克漢尼汾推出適用于現場監測和診斷的測量設備 Service Master COMPACT

- ? 數智進化,驅控未來 | 埃斯頓運動控制OPEN DAY暨新品發布會圓滿完成

- ? Aerotech 發布Automation1 2.7 激光振鏡和更多用戶功能升級

- ? 萊迪思發布先進的運動控制解決方案

- ? 關注客戶,聚焦服務,加速增長 | 2024年ABB中國運動控制重點服務渠道伙伴會議

- ? 施耐德電氣運動控制家族添新,Modicon M310運動控制器發布

- ? ADI:使用智能解決方案優化效率

- ? 派克漢尼汾攜新品亮相2024中國制冷展,賦能高效、節能、智能化制冷新生態